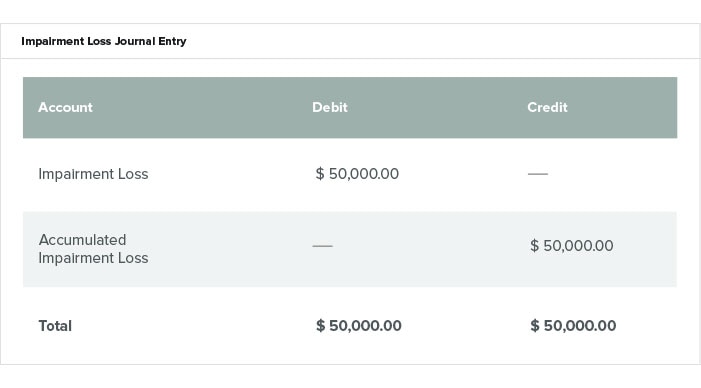

Impairment Loss Journal Entry

Under the current guidance companies can first choose to assess any impairment based on qualitative factors Step 0. In some cases you may also need to record any asset impairment that comes along ie when an assets market value is less than its balance sheet value.

Fixed Asset Accounting Made Simple Netsuite

And in the case of service organizations the word Gross receipts Revenue is used which reflects the value of.

. There is robust evidence about the critical interrelationships among nutrition metabolic function eg brain metabolism insulin sensitivity diabetic processes body weight among other factors inflammation and mental health a growing area of research now referred to as Metabolic Psychiatry. Based on the report from a technical expert the impairment loss is 50 million. Article Link to be Hyperlinked For eg.

Below is an impairment journal entry when the loss is 50000. Acquisition Cost Acquisition cost includes all the expenditures required to make an asset ready for the intended use are included in the acquisition cost of the asset. Fixed asset impairment journal entry Overview.

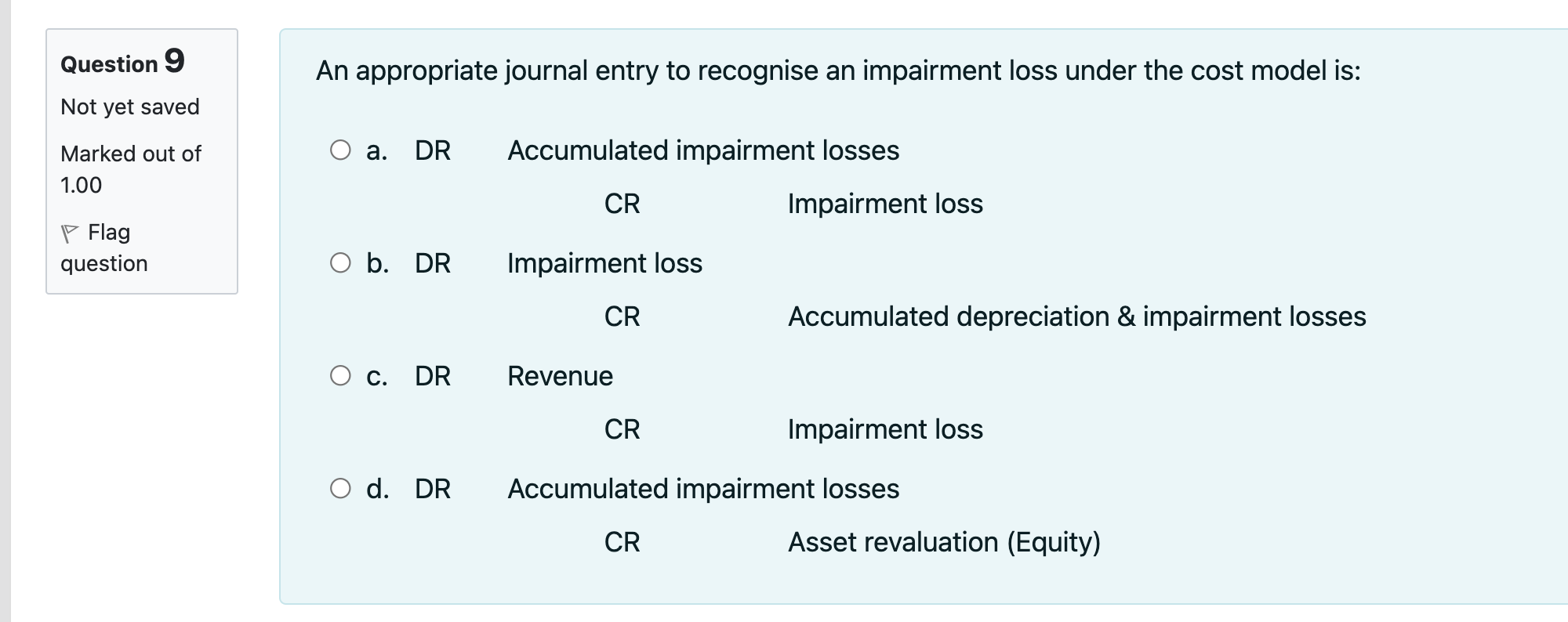

This option allows entities to first assess these factors in order to determine whether a reporting units fair value is more likely Lived Intangibles The CPA Journal June 2014If a company fails this test or decides to bypass. The journal entry would be. You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution.

Impairment loss 100000. And make an equipment journal entry when you get rid of the asset. The journal entry is debiting impairment expense 50 million and credit machinery 50 million.

A company may need to de-recognize a fixed asset either upon sale of the asset to another party or when the. First published in 1981 the American Journal of Kidney Diseases AJKD is the official journal of the National Kidney Foundation AJKD is recognized worldwide as a leading source of information devoted to clinical nephrology. In order to record the reduction in the value of the asset the loss needs to be charged to the Income Statement as an expense.

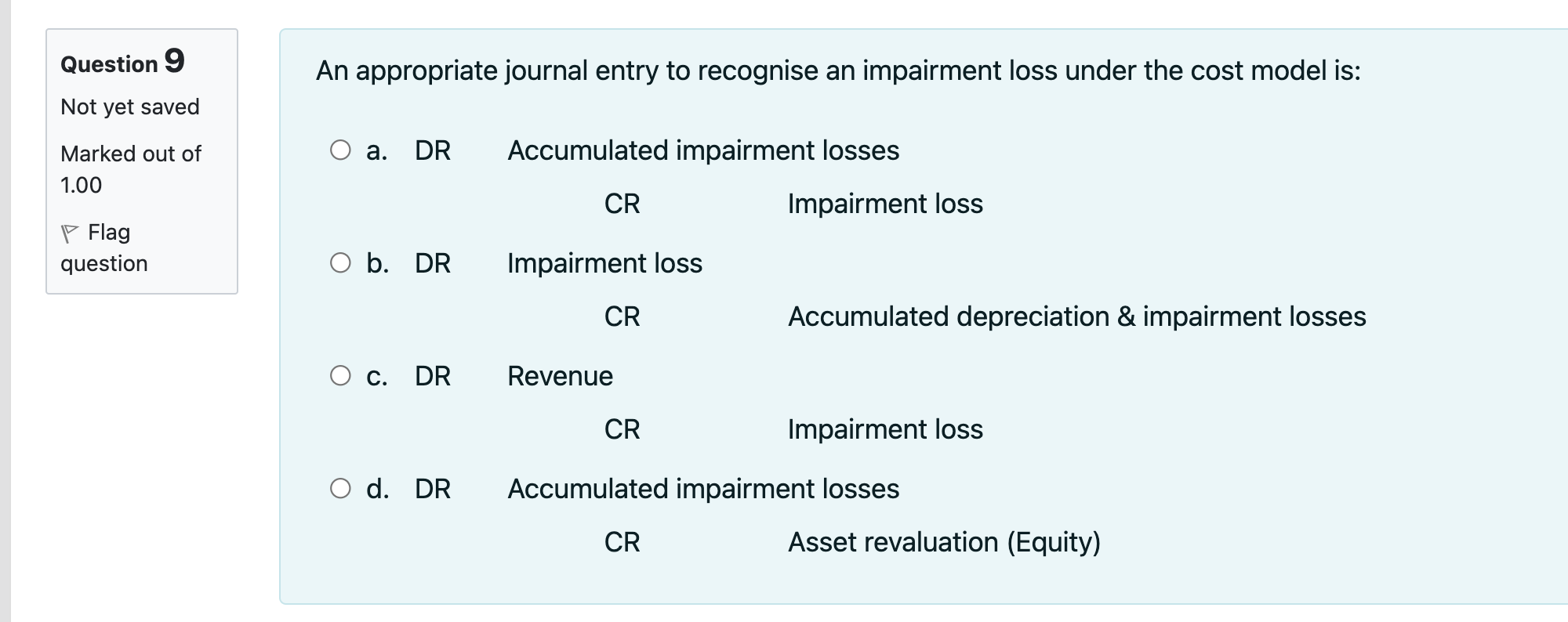

Impairment loss 400000 500000. Were going back to the basics in accounting and the objective of this post is to walk you through the correct way to book a fixed asset journal entry and how to do fixed asset accounting all the way from a new asset purchase to sale and write offWhether youre a bookkeeper or accounting clerk or an experienced staff accountant or CPA its worth. Impairment majorly constitutes a reduction in the value of an underlying asset.

Can calculate the impairment loss. Before we dive into how to create each kind of fixed asset journal entry brush up on debits and credits. The Journal publishes new research findings in the field of Adolescent and Young Adult Health and Medicine ranging from the basic biological and behavioral sciences to public health and policy.

We already have a balance of 20000 in the revaluation surplus account related to the same building so no impairment loss shall go to income statement. Impairment loss Recoverable amount Carrying value. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet recording receipt of cash and recognizing any resulting gain or loss in income statement.

Accounting Treatment for Impairment. Impairment loss assets book value assets fair value or the present value of the future cash flows expected. Receive the cash from the insurance company.

The Journal of Surgical Research also features review articles and special articles relating to educational research or social issues of interest to the academic surgical community. Contents of Profit and Loss Statement Format. It records the building using the following journal entry.

Sales Revenue Gross Receipts. The Journal of Adolescent Health is a multidisciplinary scientific Journal dedicated to improving the health and well-being of adolescents and young adults. Accounts that are likely to be written down are the.

If the fair value of property plant and equipment is lower than the carrying amount the asset is impaired and an impairment loss is recognized. In the case of a Trading Organization the word gross Sales is to be used and it reflects the sales made during the year. Contents of Profit and Loss Format are explained below.

Special Issue Call for Papers. Likewise in this journal entry total assets on the balance sheet decrease by 20000 and total. GAAP also requires goodwill and other identifiable intangible assets.

Sometimes there is a sudden drop of the fair value of the fixed asset which leads to the impairment that the company cannot ignore. When fixed assets undergo a significant change in circumstance that may reduce their gross future cash flow to an amount below their carrying value apply an impairment test. Please record the journal entry of impairment loss.

The journal entry above shows the write-off of an asset from the Balance Sheet. So we need to reduce the balance of fixed assets machinery by 50 million and record impairment expenses. Likewise if that happens the company needs to make the fixed asset impairment journal entry in order to record the loss as a result of impairment in the income.

An impaired asset is a companys asset that has a market price less than the value listed on the companys balance sheet. Severe acute respiratory syndrome coronavirus 2 SARS-CoV-2 is the pathogen responsible for the coronavirus disease 2019 COVID-19 pandemic which has resulted in global healthcare crises and. Companies are advised to carry out the impairment test only when they are sure that the assets carryingbook value cannot be recovered permanently.

The impairment may apply to one asset or a group of assets. Then records the impairment loss journal entry as. Benefits to authors We also provide many author benefits such as free PDFs a liberal copyright policy special discounts on Elsevier publications and much more.

The decrease in the fair value in this case is 20000 160000 140000 and as the balance of revaluation surplus is only 18000 in above example the excess amount of 2000 20000 18000 will go to the impairment loss account. Write off the damaged inventory to the impairment of inventory account. Operating activities Operating Activities Operating activities generate the majority of the companys cash flows since they are.

This loss will be as below. When the claim is agreed set up an accounts receivable due from the insurance company. In each case the accounting for insurance proceeds journal entries show the debit and credit account together with a brief narrative.

Impairment Loss Accounting Impairment Of Assets Held For Use Vs Intended For Disposal Youtube

Solved Question 9 An Appropriate Journal Entry To Recognise Chegg Com

Financial Accounting Lesson 9 11 Asset Impairment Losses Youtube

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

No comments for "Impairment Loss Journal Entry"

Post a Comment